Oil surged past $105 per barrel and equities tumbled Thursday after key crude producer Russia sent forces into Ukraine, accelerating fears of a major war in eastern Europe.

Asian and European stock markets nosedived — with Frankfurt shedding five percent in mid-afternoon trading — as investors fled risky equities, while haven investment, gold, rose to just over $1,955 per ounce.

After weeks of warnings from the United States and other powers, Russian President Vladimir Putin ordered a wide-ranging offensive into its neighbour, sparking fury from other world leaders and vows to ramp up sanctions on Moscow.

In reaction, oil rocketed more than eight percent, with European benchmark Brent prices briefly cruising past $105 per barrel for the first time since 2014, while aluminium and wheat surged to record peaks on fears over output from major exporter Russia.

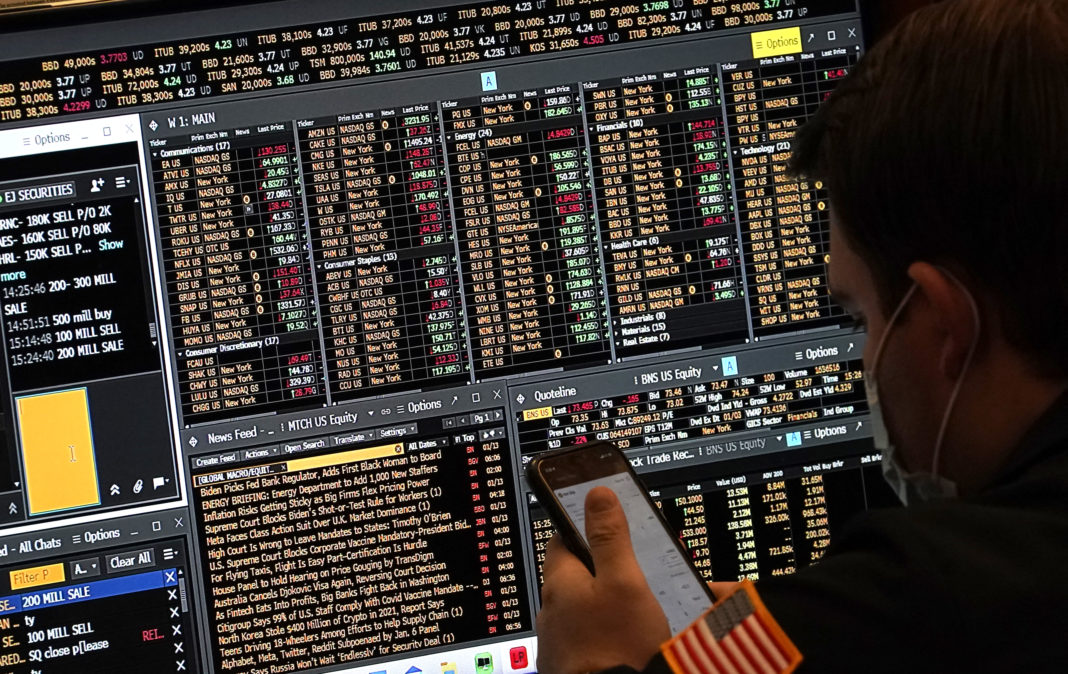

– ‘Sea of red’ –

“There is a sea of red across global markets,” said Interactive Investor analyst Victoria Scholar.

“After Russia’s invasion sparked an initial spike higher, oil prices have continued to travel north as markets assess the hit to energy supply that is likely to come as a result of the conflict.”

Asian equities plunged, with Hong Kong, Sydney, Mumbai, Singapore and Wellington down at least three percent, while there were steep losses in Tokyo and Shanghai.

London shed more than three percent in mid-afternoon trading, as fears grew of a broader conflict.

Wall Street followed, with the Dow slumping about two percent shortly after opening.

Analysts pointed to fear of the unknown driving the markets, especially over retaliatory sanctions by the West and how Russia will respond.

“There is uncertainty about how much lower stock prices will fall, so there is a bit of a sell-first-ask-questions later mentality in the market right now,” analyst Patrick J. O’Hare at Briefing.com said.

– Russia-exposed firms hit –

Companies with the biggest presence in Russia were among those whose share prices were getting hammered.

Shares in Russian metal giants Polymetal and Evraz tanked by 49 percent and 29 percent respectively in London.

“With tough incoming sanctions expected, their businesses are likely to take a major hit with little respite in sight given the seriousness of the situation,” said Hargreaves Lansdown analyst Susannah Streeter.

French carmaker Renault, which owns a majority stake in Russia’s Avtovaz, the maker of the Lada, saw its shares skid 11 percent.

Also in Paris trading, Societe Generale dived 12 percent on concerns over its Russian retail banking subsidiary Rosbank.

“There will be pressure on (European) banking stocks, particularly banks in France and Austria as they have the largest exposure to Russian loans,” added Streeter.

Germany’s Deutsche Bank also shed 11 percent.

Other haven assets profited, with the Swiss franc hitting a five-year peak versus the euro.

The ruble fell nearly six percent to 86.7 rubles to the dollar, while the Moscow stock exchange’s MOEX index plunging 34.9 percent after suspending trading early in the day.

“It is hard to find any reasons for the selloff to reverse now that it appears the tanks are rolling,” said OANDA’s Jeffrey Halley.

“Stronger sanctions are to come on Russia and energy prices will inevitably head higher in the short term.”

– Gas prices spike –

European natural gas prices vaulted higher on disruption worries, particularly after Germany this week halted the approval of the Nord Stream 2 pipeline from Russia.

Europe’s reference Dutch TTF gas price jumped about a third to hit more than 126 euros per megawatt hour.

Domestic energy prices had already rocketed in Europe during recent months, fuelling decades-high inflation that has caused central banks to raise or prepare to raise interest rates, which could in turn slow the economic recovery.

– Key figures around 1430 GMT –

Brent North Sea crude: UP 7.6 percent at $104.20 per barrel

West Texas Intermediate: UP 7.7 percent at $99.20 per barrel

London – FTSE 100: DOWN 3.3 percent at 7,248.38 points

Frankfurt – DAX: DOWN 5.1 percent at 13,887.39

Paris – CAC 40: DOWN 4.3 percent at 6,486.65

EURO STOXX 50: DOWN 4.6 percent at 3,791.55

New York – Dow: DOWN 2.1 percent at 32,421.63

Tokyo – Nikkei 225: DOWN 1.8 percent at 25,970.82 (close)

Hong Kong – Hang Seng Index: DOWN 3.2 percent at 22,901.56 (close)

Shanghai – Composite: DOWN 1.7 percent at 3,429.96 (close)

Euro/dollar: DOWN at $1.1148 from $1.1307 late Wednesday

Pound/dollar: DOWN at $1.3349 from $1.3544

Euro/pound: UP at 83.54 pence from 83.48 pence

Dollar/yen: UP at 115.02 yen from 115.01 yen

burs-kjm/rl

© Agence France-Presse