CBCS sold 30% of its total gold reserves investing the proceeds

WILLEMSTAD.- The Centrale Bank van Curaçao en Sint Maarten (CBCS) recently

sold 30% (125,000 out of a total of 420,394,993 fine troy ounces) of its total gold reserves in order to enhance its resilience and increase revenues, investing the proceeds in fixed income securities (U.S. government bonds). This optimization of the composition of the official reserves and the resulting increase in revenues will have a positive effect on the CBCS’s results and the targeted annual dividend payment to Curaçao and Sint Maarten pursuant to Article 40 of the Bank’s Charter.

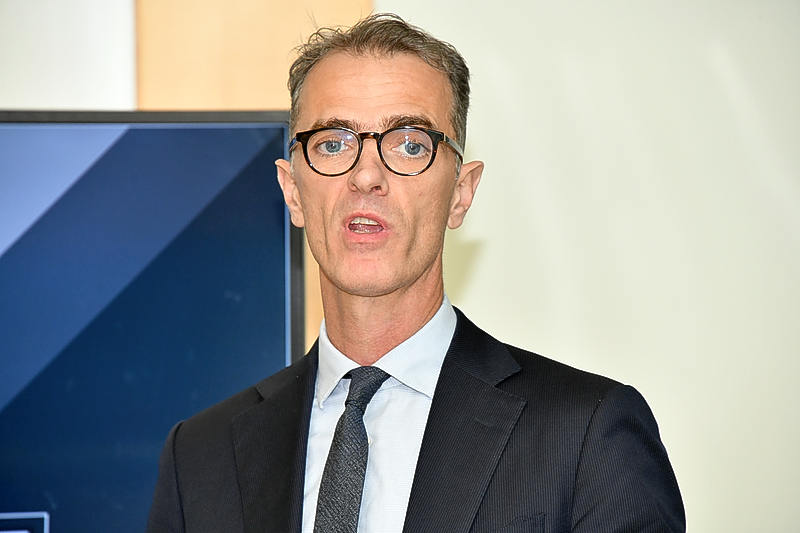

“Prior to the sale, the CBCS’s capacity to absorb operational losses was nil, meaning that, in accordance with the Bank’s Statute, the Countries had to immediately replenish its capital in the event of any financial setback,” CBCS President Doornbosch explained.

“The CBCS would like to emphasize that this sale of gold only changed the composition of the official reserves and not their volume. The transaction therefore has no impact on the stability of the guilder’s peg to the US dollar. The stability of the peg remains assured,” said Richard Doornbosch.